Credentialing & Enrollment Solutions

Simplified Credentialing & Enrollment Management

Optimize Healthcare Operations for a Simple & Seamless Experience

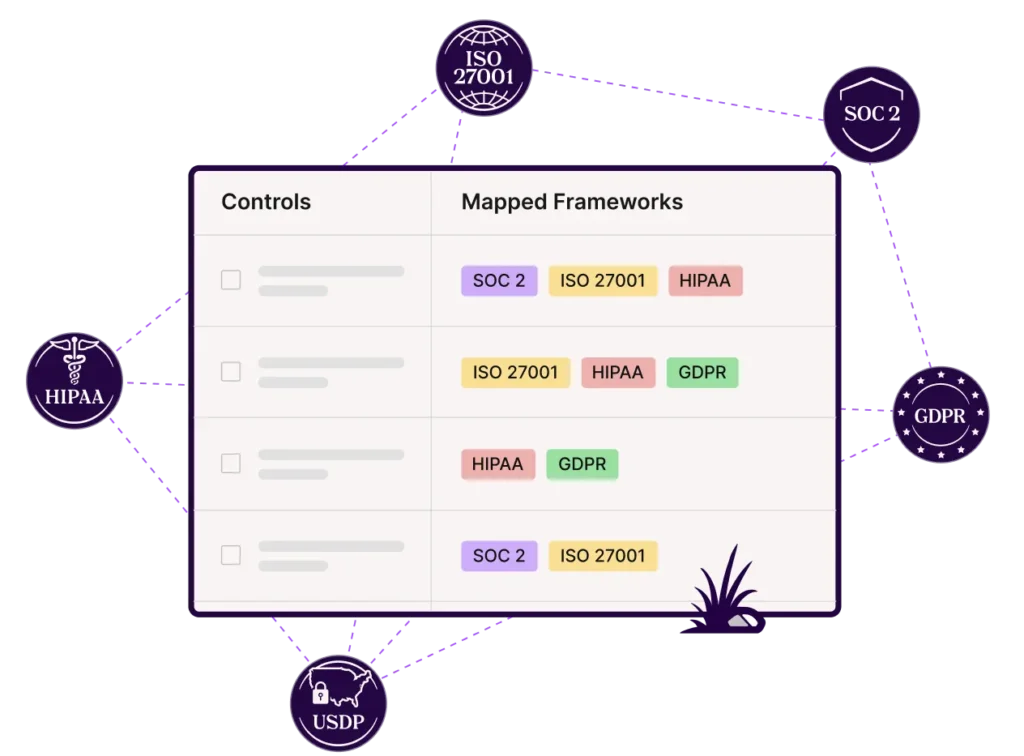

Apaana automates up to 90% of the work for security and privacy frameworks

360° professional services suite for private and larger healthcare facilities

Let us handle the paperwork while your team focuses on providing the best care. We ensure to provide the best credentialing and enrollment services to upscale the healthcare facilities.

Credentialing

We streamline the process, verifying qualifications, licenses, and certifications for healthcare professionals. Our team ensures compliance and reduces risks.

Licensure

Facilitate licensure processes efficiently with our comprehensive support and guidance tailored to your professional requirements.

Re-Credentialing

Streamline re-credentialing with our expert assistance, ensuring compliance and continuity in your healthcare practice or organization.

Enrollments

Simplify enrollments procedures with our specialized services, ensuring accurate submission and swift approval.

Closed Panel Appeals

Navigate closed panel appeals confidently with our advocacy and strategic guidance, ensuring fair resolutions and optimal healthcare access.

Easy Onboarding

Experience easy onboarding with minimal information.

High Frequency Follow-ups

We get the application moved faster on the payors’ end.

Live Tracking

Transparency with work order status on our Health Stream Software.

Tech Solutions

Maximize your operational efficiency with our cutting-edge technology.

Compliance programs and security verifications

Our HIPAA-compliant billing platform and coding strategies prioritize patient data security with best in class technology.

We adhere to SSAE-18 Type 1 SOC 2 standards, ensuring robust privacy measures with advanced technology and rigorous audits by third-party experts.

97%

of seamless & thorough onboarding, handling every detail with precision and professionalism.

90%+

of applications are approved within 90-120 days. Our process meets payor timelines for swift approvals.

80%

of clients refer us for professional service standards, expertise, and responsiveness.

Building Trust, Building Businesses

Simplified Payor Processes

Submit, follow up, and update credentials with ease. Our streamlined approach keeps your payor relationships running smoothly.

Verifying Credentials

We liaise with licensing bodies, educational institutions, former employers, and healthcare agencies to ensure every credential is verified and validated.

Fast Processing

Apaana automates 25% more evidence than any other solution.

Get compliant faster and close deals sooner.

Collaboration Process Technology

We engage with all stakeholders on your behalf to ensure you have zero burden.

Smart & Powerful

Solutions That Enables You Track Your Requests.

- Super quick onboarding.

- 100% visibility with real time dashboards.

Cilent's Testimonials

Trusted & Approved by Industry Leaders

FAQs

What is Provider Enrollment?

Provider enrollment, also known as payor enrollment, involves applying to health insurance networks to join their provider panels. Once approved as a participating provider, the next phase commences: contracting.

Why do you need Credentialing and Enrollment?

To put it simply, you get to see more patients. If you have enrollments across a larger number of Insurance panels and have the participating status you can see them without high co-pay.

How much does Credentialing & Enrollment cost me?

Our per-application pricing depends upon volumes. If they are a larger number of insurances then you get a good discount.

Our per-application cost ranges from $130 to $200 per payor application. Besides this, we have a setup fee or Provider / Group / Facility that allows us to build their profiles with no room for error.

When do Credentialing and Re-Credentialing occur?

Credentialing happens before a provider is considered eligible to participate in an insurance network. Re-Credentialing is done every 1-3 years after the original effective date of the Provider to make sure that all of the information listed with the insurance panel is up to date and accurate.

What is Delegated Credentialing?

Delegated Credentialing is done when groups are large enough (such as hospitals or universities) the payors can grant an addendum to a contract allowing the group to maintain their own Credentialing. This saves time since the payors can be inundated with applications and get backlogged. With Delegated Credentialing, the group or its contracted company is responsible for completing the primary source verification process typically performed by the insurance company. It’s the responsibility of the delegated entity to ensure that all providers meet the standards as set forth by the insurance company. Once the provider is Credentialed at the facility (such as a hospital) the entity would send each delegated payer a roster (typically once a month) showing all employed Providers and any new additions since the last report.

How do I obtain a CAQH ID number and what does maintenance entail?

Almost all private commercial insurance panels will require providers to have or obtain a CAQH ID. If you don’t already have one, we are able to create one for you! Let your specialist know and we’d be happy to add it to your project. Every four months, you will receive a request from CAQH to re-attest that all of the information in your application is correct.

Do I get to choose the panels I want to be on?

Yes, you get to choose exactly which panels you want, and don’t want, to be credentialed with. If Panels are closed we offer replacement panels at no extra cost.

What insurance panels should I choose to enroll with?

We can help! An Apaana Specialist can help with some recommendations, your decision on the panels is final and we will go with that. Our recommendations on panels come from ncqa.org besides other sources.

How do insurance panels gather Credentialing and Enrollment data?

Many Private commercial insurance panels will take the information from your CAQH profile in order to initiate the process.

If a provider submits an application on the payor website for the respective panel, the application will go through the process and the private commercial payor panel will typically access your CAQH profile to verify the information on your application.